FAQs

Learn More About Investing in Your Values.

Take a look at the answers to your questions below. Then pledge today!

What is the Capital Campaign?

A Capital Campaign is an effort by an organization to raise a large amount of money in a specified period of time in order to fund a one-time need – in this case, the creation of Wild Onion Market.

Why does Wild Onion Market need to conduct a Capital Campaign?

How much money is needed and in what time frame?

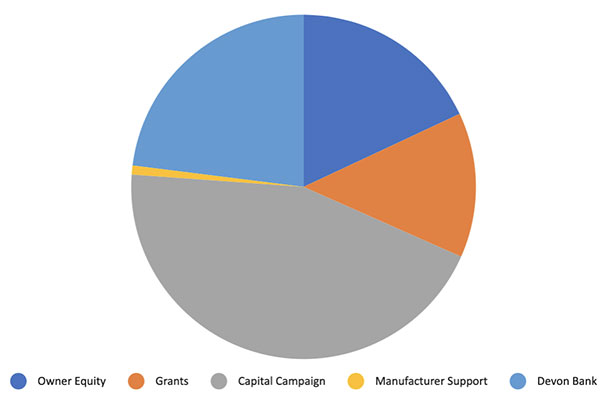

Our campaign is targeted to raise $1.16 million. The total funding required to open our store is $2.6 M and is broken out in the following pie chart.

We project that we will need $2.6 million in order to open our store.

$1,160,000 will come from Owner investments and donations.

$600,000 will come from bank loans.

$470,000 will come from Owner equity

$355,000 will come from grants

$22,800 will come from manufacturer support

Total funds needed: $2,607,800

We have already raised $1,066,360 from our owners. The balance needed is $93,640. This amount must be raised to open the store.

Are there other sources of funds available to the co-op?

In addition to funds from owners via Preferred Shares, Owner Loans, and donations, the remaining capital will come from:

- Bank loans

- Member equity (from the purchase of Ownerships)

- Grants

I already invested in the co-op when I became an Owner. Isn’t that enough?

Your Ownership is the terrific first step that gives you the right to vote for Board members and to run for the Board, giving you input into how the store is governed. And now, as an Owner, you have another exclusive opportunity: to invest further in your store, in your community, and in your values, with the potential to earn a fair rate of return. Owner Loans and Preferred Shares are long-standing mechanisms used by co-ops across the country to raise the money needed to open a store. Loans and Preferred Shares demonstrate a loyal customer base and reduce debt service, making the co-op stronger. Donations to the co-op further strengthen our financial position because they do not require interest or dividend payments.

What's in it for me?

You have the opportunity both to earn a potential return on your investment and to know your money will be invested locally. You can enhance the quality of life for our entire community and for our local farmers. When you invest in the Capital Campaign, you have the opportunity to move money from Wall Street to our streets, where it can make tangible things , like the co-op, happen in our community.

Is there a deadline to raise the funds needed to build our store?

Yes, if we want to stay on our path to opening and secure the financial stability of the co-op, we must raise the needed funds by opening date.

What will my money do?

Investments will fund construction, hire staff, purchase equipment, fund working capital and stock the shelves.

What are my options for investing?

There are two options for Owner investment:

1) Preferred Shares: Owners who live in Illinois can purchase up to 7.5 Preferred Shares at a price of $1,000 each, with a minimum investment of 2 shares ($2,000.00). Since Owners already own 2.5 shares of common stock and, by state law, the maximum number of shares of any type allowed in a co-op for any individual is 10, 7.5 is the maximum number of Preferred Shares that an Owner can purchase. More information is available in our Owner Only Investor Packet or non-owners can request more information by emailing invest@wildonionmarket.com.

2) Loans: Owners who live in Illinois can make a loan starting at $5,000.00 to the co-op and earn interest.

Eligible owners have the opportunity to purchase preferred shares AND make a loan.

How do I make an investment in the Capital Campaign?

Email us at invest@wildonionmarket.com. You also have the option to complete a pledge form which can be found here: https://forms.office.com/r/8wP9eXDa3s

Can I purchase Preferred Shares and also make a loan?

Yes, Wild Onion Market owners living in Illinois are eligible to purchase up to 7.5 Preferred Shares of stock and also extend a loan.

What is the best way to help the co-op?

Purchase Preferred Shares, then, if you can invest more, consider a loan in addition to your shares. Selecting low or zero interest on your loan is also extremely beneficial to the co-op. Optionally, a large tax-deductible donation skips the paperwork and is another great way to support the co-op.

What are the risks of investing in Wild Onion Market?

As with any investment in a business, there are risks to your investment and you are required to read our investment documents prior to investing.

What is the deadline to invest?

Funding for the co-op must be secured by opening date to secure the co-op's financial footing.

Can I invest in the co-op out of my IRA or 401K?

Absolutely. The first step is to request the investor packet by emailing us at invest@wildoinionmarket.com. You can then review that with the fund broker.

What if I move?

No problem! Simply update your address with us when you move. You must live in IL to make the initial investment and as long as we have your current address on file you are all set.

What happens if we don’t reach our goal?

We fully anticipate meeting and exceeding our goal. However, if we fall short, the board of directors will take a hard look at our progress and make decisions about the co-op’s next steps. Possible consequences include incurring un-budgeted expenses, including additional months of rent and increased equipment costs, as well as a delayed opening date. In short, not meeting our goal puts the co-op’s financial stability at risk. Starting any business has risk, but when you start out undercapitalized, your chance of success diminishes.

What happens if I pass away? Can I designate a beneficiary?

We encourage you to keep the paperwork associated with your investment with your other important financial documents and to consult your estate planning advisor. A joint subscriber can be designated on the investment agreements so when the cooperative is notified about the deceased, the investments will transfer to the joint subscriber.

How else can I make the Capital Campaign a success?

Thanks for asking! There are a number of ways that you can help:

- Encourage your friends, co-workers, and neighbors to become an Owner.

- Volunteer by emailing hello@wildonionmarket.com

- Like and share our social media posts.

Preferred Shares

What is a Preferred Share?

Preferred Shares are non-voting stock that could yield annual dividends. Any Owner who lives in Illinois can participate and buy up to 7.5 Wild Onion Market shares at $1,000 per share, with a minimum investment of two shares ($2,000). Outside of donations, Preferred Shares are the most co-op friendly way to invest, because they show up as equity (not debt) on the co-op's financial statement. They should be considered a long-term investment (15+ years). They can yield annual dividends but like most stock investments, there is risk and no guarantees.

What are Preferred Share dividends?

Dividend distributions on the Preferred Shares will be made at the Board’s sole discretion. Shares have a target dividend rate of 3%. However, in any given year the Board, in its discretion, may choose not to distribute a dividend, based on the financial performance of the co-op that year. Dividends accrue in years when they are not paid.

Can I sell my Preferred Shares?

The Shares may not be sold to third parties. Instead, they may only be sold back to the co-op, subject to the Board’s approval. The co-op does not plan to redeem Shares before it becomes profitable and all loans are repaid.

How do I pay for my Shares?

When you make a pledge to purchase preferred shares you’ll receive legal documents to complete via DocuSign. Once those documents are signed by you and the co-op, you’ll receive an email invoice. Using that invoice you can mail your check made out to Wild Onion Market to P.O. Box 607262, Chicago, IL 60660. You will also have the option to pay via an ACH transfer directly from your bank account. Once we receive funds, you’ll receive a Notice of Shares certificate.

Owner Loans

What are Owner Loans?

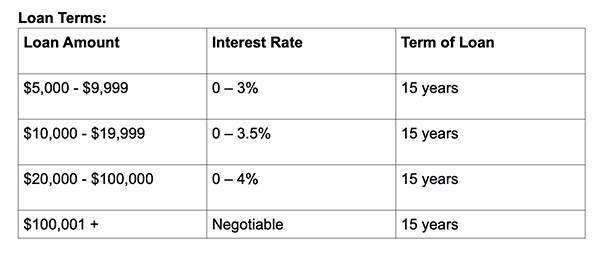

In short, owner loans are the co-op borrowing money from YOU (our owners) instead of borrowing money from the bank. Loans are a 15-year investment with interest rates up to 4% based on the amount of the loan. Loans are available only to Wild Onion Market Owners living in Illinois who want to make an investment of $5,000.00 or more.

What rate does the co-op pay on loans?

The interest rate paid on loans is dependent on the amount of the loan. A range of interest rates apply to each loan level. That range gives you the lender the opportunity to be flexible with the co-op and choose a lower interest rate to further benefit the co-op. See the chart below for specific interest rates.

When will loans be repaid?

Loans to Wild Onion Market carry a 15 year term meaning that we intend to fully repay the loan by year 15. Interest will accrue for the first 5 years of the loan. In year six all accumulated interest will be repaid. In years 7-10 interest will be paid annually. In years 11-15 interest plus ⅕ of the principal amount will be paid each year, with the loan being fully repaid in year 15.

How do I pay for my Loan?

When you make a pledge to loan funds to the co-op you’ll receive legal documents to complete via DocuSign. Once those documents are signed by you and the co-op, you’ll receive an email invoice. Using that invoice you can mail your check (made out to Wild Onion Market) to P.O. Box 607262, Chicago, IL 60660. You will also have the option to pay via an ACH transfer directly from your bank account. Once funds are received you will receive an emailed Promissory Note, which is the final step in the loan process.

Donations

Can I make a tax-deductible donation?

Yes! Tax-deductible donations can be made online or by check.

Make an online donation at https://www.givemn.org/donate/Cooperative-Development-Fund-Of-Cds. Be sure to designate Wild Onion Market using the drop-down menu on the form. Or mail a check payable to: Cooperative Development Fund of CDS to Wild Onion Market, P.O. Box 607262, Chicago, IL 60660.

We pay fees on online donations which makes mailing your check the most cost effective way to make a donation.

Can my employer match my donation?

Absolutely! If your employer has a charitable donation match program, that's a terrific way to double or triple your impact. Email us at invest@wildonionmarket.com to get started.

The Project

Has a market study been completed?

Yes. Several site evaluations and sales forecast analysis studies were performed from 2016 through 2021 by reputable firms, used by most food co-ops. The result is a feasible business projection. More in-depth information from these evaluations can be found in our business plan and market study summary, available upon request.

Where is the store going to be?

Wild Onion Market is located at 7007 N. Clark St., in Rogers Park. We took ownership of the location and began to make rent payments of $12,000 per month starting May 1. This location is at the corner of Lunt Ave. & Clark St., on two bus lines (#22 Clark & #96 Lunt), near both the Red Line and the Metra, and has a Divvy station across the street.

Why did we choose this location?

Our location is wonderfully accessible from all directions and by all forms of transportation—on foot, by bicycle, by public transit, and by car. It has parking and we will eventually have a bike rack. It is also extremely sustainable. The space was formerly a grocery store, enabling re-use of equipment. Because we are able to reuse equipment, it makes the space very affordable. Lower equipment costs, means a lower project cost.

What is the timeline for opening the store?

With a successful Capital Campaign, we will open the store and ensure financial stability for the co-op.

What will be the impact of Wild Onion Market on other local groceries (such as Morse Market, Rogers Park Fruit Market, Devon Market)?

In the cooperative world, we believe the rising tide raises all ships. It has been and continues to be our intent to work closely with neighborhood businesses to ensure that our community has access to the fresh, healthy food it deserves. As demand for local products continues to increase we will support our neighbors and the local business community.

How will Wild Onion Market be different from other grocery stores?

Wild Onion Market’s focus on a resilient local, sustainable food system built by the community and benefiting both the local community and our local farmers set it apart from competitors.

Your Wild Onion Market will do its part to build a responsible and just local food system that puts people and planet before profit. The co-op will strengthen the local economy by keeping your grocery dollars in the community. Fresh, healthy, local food is a right, not a privilege. Wild Onion Market will improve e access to good food for all while supporting local, sustainable food producers.

I have a question that isn’t listed here.

You can contact us with questions about the Capital Campaign at invest@wildonionmarket.com.